Morgan Stanley Sets Expectations on Netflix Stock Ahead of Earnings

Another earnings season is about to kick off and Netflix (NASDAQ:NFLX) investors are entering it in a buoyant mood. The shares are up by 27% so far this year, boosted by a Q4 report which featured the best subscriber growth on display since the pandemic.

Ahead of the streaming king’s Q1 readout (Thursday after the market close), the bullish sentiment is echoed by Morgan Stanley’s Benjamin Swinburne, a 5-star analyst rated in the top 4% of the Street’s stock pros.

“Netflix’s track record includes pivoting from DVD to streaming, scaling the world’s largest studio, and successfully monetizing password sharing,” said the 5-star analyst. “This track record, combined with new call options (ads, games, live sports) and a 25%+ EPS CAGR, supports a premium multiple and keeps us Overweight.”

That Overweight (i.e., Buy) rating is backed by a new $700 price target, implying shares will climb another 13% from here. (To watch Swinburne’s track record, click here)

Swinburne thinks Netflix has plenty going for it right now. Not only does its combination of non-US content, original programming, and deep library represent competitive advantages that “may all be under-appreciated,” the success the company has had in implementing paid sharing has increased Swinburne’s “willingness to underwrite success in advertising and games over time.”

The analyst reckons that between 2Q23 through 4Q23, Netflix probably experienced a boost of 10-15 million additional subscribers due to the implementation of paid sharing. Moreover, he estimates that an additional 8-12 “extra members” likely joined through sub-accounts. “We expect another healthy contribution from paid sharing implementation in 1Q24,” he goes on to say.

Swinburne is also now calling for more net adds than he previously anticipated. For Q1, he sees net adds of 7.5 million (up from 4.5 million beforehand) and 25 million for the full year. For the record, Netflix guided for its net adds in Q1 to be up vs. the 1.75 million seen in the same period last year but down from the 13.1 million of Q4, and Swinburne’s revised estimate lands at roughly the midpoint of those two results. Additionally, as measured by engagement, Swinburne’s analysis shows that there were more “break-out” hits in 1Q24 vs. 4Q23, offering support for the analyst’s raised estimates. “Given the high incremental margins of incremental revenue, the increased net adds outlook drives higher EPS estimates,” Swinburne further added.

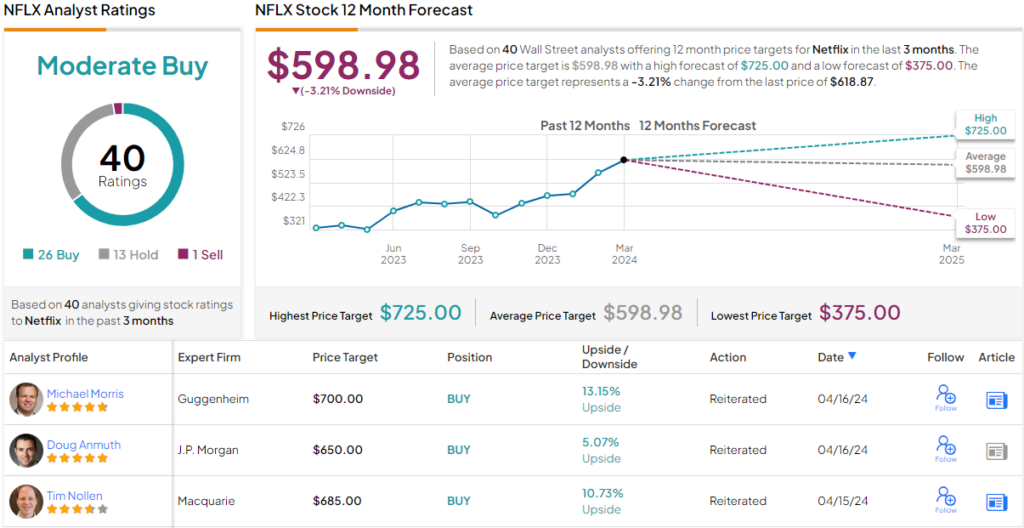

So, that’s the Morgan Stanley view, what does the rest of the Street have in mind for Netflix? Based on a mix of 26 Buys, 13 Holds and 1 Sell, the stock claims a Moderate Buy consensus rating. That said, the $598.98 average target sits 3% below the current trading price. (See Netflix stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.