Why it may be the right time to invest in gilt funds; check top performers

The current valuations in the mid-cap and small-cap sectors are high.Investing in long-duration debt is advised by them, anticipating the beginning of a rate easing cycle expected in the latter half of FY25.

In the past year, the Nifty Smallcap 250 surged by 69%, the Nifty Midcap 150 by 59.4%, and the Nifty 50 by 27.77%. The significant surge would likely have resulted in an overall increase in equity allocation within investor portfolios heavily weighted towards stocks. As per DSP Mutual Fund’s newsletter Netra, the market capitalization to GDP ratio for small-cap and mid-cap stocks stands at 52%, marking its highest level on record. This contrasts with the long-term average of 29% for this ratio.

Wealth managers emphasize the need for investors to reduce equity exposure in such richly valued markets and shift towards debt investments. They recommend long-duration or gilt funds as the preferred options for this adjustment.

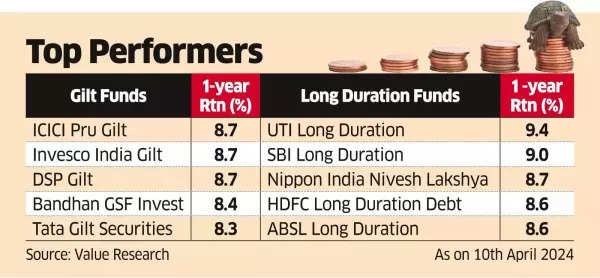

Gilt Funds: Top Performers

Nikhil Gupta, founder of Sage Capital, suggests that investors with high equity allocation, especially in mid-caps and small-caps, can rebalance their portfolios by moving towards debt instruments.

Experts anticipate a delay in rate cuts due to rising US inflation but believe they will commence in the latter part of the year. Vikas Garg, head of fixed income at Invesco Mutual Fund, predicts a downward trend in the 10-year benchmark bond yield to 6.7% by year-end.

The RBI is expected to reduce rates by 25-50 basis points later in the year, following a global trend. This could result in capital appreciation in long-duration and gilt funds, potentially offering double-digit returns to investors.

Long-duration funds with a 10-year modified duration could yield a capital appreciation of 2-3% in the next year, combined with a coupon of 7.2-7.5%, resulting in a total return of 9-10% on such funds.