Datadog Q1 Earnings Preview: Market Consolidation Is Key (NASDAQ:DDOG)

Thapana Onphalai/iStock via Getty Images

Investment Thesis

Datadog (NASDAQ:DDOG) is slated to announce their Q1 FY24 earnings report for their first quarter of this year next week on Tuesday, May 7th, before markets open.

The NYC-headquartered maker of data observability & development operations (DevOps) products and solutions recently concluded their 2024 Investor Day in February, close on the heels of their full-year FY23 earnings announcement, which beat consensus expectations but guided FY24 revenue under market forward estimates.

Datadog would have been trailing the market indices for the year if not for the stellar earnings reports from Microsoft (MSFT) and Google (GOOG), which reported strong cloud business growth in their respective earnings reports last week. These results from the cloud titans raised the possibility of strong spending across may tech companies that operate cloud-based businesses on Friday last week.

Datadog is at par with broader markets so far this year (sa)

The earnings results from Microsoft and Google are an important factor to consider, given that both hyperscalers maintain cloud partnerships with Datadog. But there are other factors, such as vendor consolidation. Unfortunately, I believe Datadog still trades a premium valuation relative to its earnings and revenue growth as it heads into its Q1 earnings next week.

Based on my analysis, I recommend a neutral view of Datadog before its earnings announcement.

Datadog’s FY23 results were all about Land and Expand with Customers

I had covered Datadog back in February, where I mentioned that “Datadog is a great company that is very well run by management in all aspects of product, sales, and financial operations.” I had also mentioned at the time that Datadog was fully valued. Since then, the company’s stock has moved sideways, in line with my previous outlook.

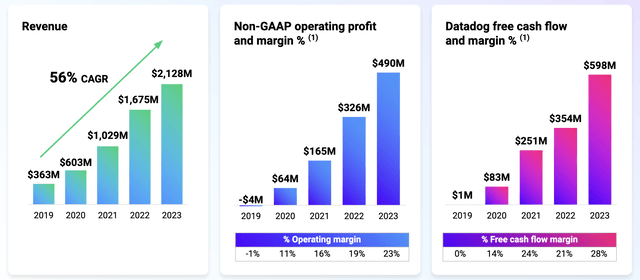

Last year, Datadog’s revenue grew 27% y/y to $2.12 billion, driven by higher adoption of products by the company’s customers who previously landed with Datadog. As seen below, revenues have grown at a 56% CAGR over the last five years, while both operating income and free cash have grown astronomically on an adjusted basis.

Datadog reported strong growth across revenue, adjusted operating and FCF margins (Company sources)

In lieu of exact ARR numbers, since they are not provided, I will look at the company’s growth in customers contributing an ARR of +$100K. At 3190 customers, this customer segment represented 86% of the company’s ARR in FY23, up from 2,780 as of December 31, 2022, representing 85% of our ARR. Based on slide 117 from their 2024 Investor Day Presentation, I see that Q4 in FY23 represented the first quarter in the past six trailing quarters where the company reported sequential growth in ARR. But the slides below show the strength of the company’s Land and Expand model.

In the Investor Day presentation, I noted that Datadog’s current logo penetration in its target market is ~5% of the ~530k logo opportunities it targets. But the company is effectively cross-selling new customers with other products and expanding product adoption, as I mentioned in my previous coverage. The Investor Day presentation demonstrated the strength of that model, as seen below.

Approximately half of Datadog’s customer base uses at least 4 products or more. But a growing number of customers have at least 6–8 products that they use from Datadog. This last segment of customers has been Datadog’s growth driver, which really started in 2021 as growth in the 2+ category started maturing.

Datadog’s Annual Recurring Revenue by type (2024 Investor Day Presentation, Datadog)

Per management, this success in 2023 mainly came from large consolidation deals, which is a trend that persisted through 2023. I remember coming across this Gartner survey in 2022, which predicted CIOs at organizations were working towards consolidating their security solutions. That outlook continued to play out and expand to the larger DevOps space, per my observation of management’s commentary in an excerpt from their Q4 earnings call where they explain the rationale behind a customer choosing to consolidate vendor platforms, putting Datadog in a position to win market share:

I will say though, having the growth portfolio of product also really helps with this consolidation deals in particular. Sometimes — maybe a couple of products are only going to get us $100,000 each as part of a $5 million deal. But having those two products help the customer rationalize what they have on the other hand save us million dollars and have made the case for the other $4.8 million of the deal. So it’s really — the platform as a whole really has a strong impact beyond the revenue of some of the individual products.

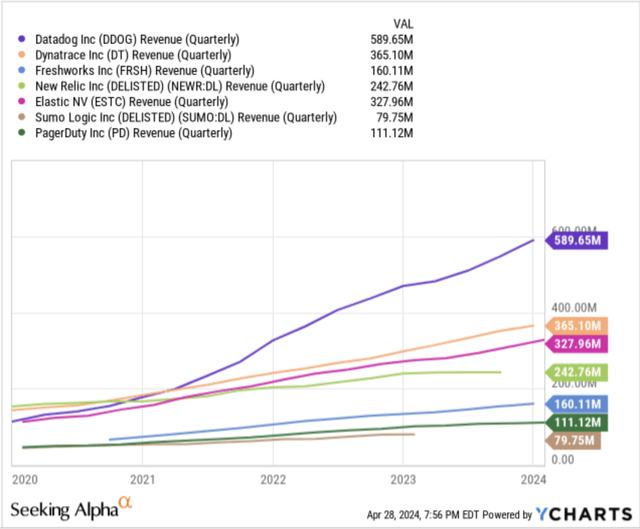

Vendor consolidation is something management alluded to even at the recent Morgan Stanley TMT Conference last month. Datadog’s own Investor Day presentation suggests that 55% of the +$1 million deals in 2023 were won because customers were trying to consolidate their data observability tech stack, and this led to ~4x growth in annualized bookings versus those deals that did not involve vendor consolidation. When I compared Datadog’s past revenue with some of its competitors, I saw that a lot of the explosive growth in Datadog has been observed since mid-FY21.

Datadog’s quarterly revenue from 2020 to 2023 versus some of its competitors (YCharts)

This also coincides with the observations I made earlier about customers expanding their adoption of Datadog’s products from 2+ and 4+ products to 6+ and 8+ products. I believe this has been one of Datadog’s key strengths in the past, which has led to higher revenues, as seen above. This chart also presents an interesting manifestation of how Datadog has been consolidating its market share over the years.

In the Q2 earnings call next week, I will be keenly listening to understand whether these trends continue to remain intact for Datadog, as they have been crucial to Datadog’s growth in the past. Management has repeatedly focused on.

Can Datadog be profitable on a GAAP-basis?

I had noted in a chart earlier that Datadog has been able to demonstrate strong performance in its income growth as well as in its free cash line items. In 2023, the company said that unlevered free cash margins expanded by a massive 600 basis points to 28% as Datadog recorded almost $600 million in free cash last year.

At the same time, management reported that operating income grew to $490 million, up a solid 50% y/y on an adjusted basis, leading to adjusted operating margins expanding by 400 basis points to a respectable 23%. The company came within striking distance of breaking even on a GAAP operating basis after reporting GAAP operating margins of -2%, better than -4% GAAP operating margins last year.

Based on the last known guidance issued in February, management expects adjusted margins to decline slightly this year, possibly due to higher spend on sales/marketing activities. In FY24, management projects adjusted operating margins to decline to a range of 21.8%–22.3%. At the moment, I am not expecting the company to become profitable on a GAAP basis in FY24, although it would be a positive development for Datadog. Over the long term, the company still projects adjusted operating margins to grow to +25%.

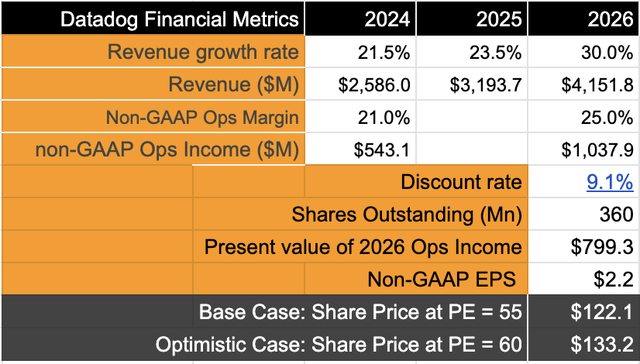

Valuation suggests some downside for Datadog

My revenue growth assumptions from my previous coverage of Datadog still stand. I believe there has been no material change in those views and expect the company to grow at a compounded growth rate of 25% between FY23 and FY26. Assuming the company can grow its adjusted operating margins to 25% per its guidance, the company should be growing its adjusted operating income by 28.4% CAGR over the same investment horizon. I will be factoring in a higher discount rate of 9.1% to account for changes in equity risk premiums (calculations here).

Datadog’s valuation model (Author)

With the growth rates estimated above, I believe a forward earnings multiple of 55x would be warranted in Datadog’s case. But I see that despite a relatively expensive forward PE, there still exists some downside in Datadog’s stock.

Of course, range-bound/lower dollar and stable/lower interest rate environments will be favorable for Datadog and its tech peers, which is currently factored into the assumption. However, if any of these situations change, it may impact business spending, leading to some headwinds for Datadog.

On the competition front, I see that Dynatrace has reclaimed the leadership position according to Gartner’s recent study of the Application Performance Monitoring and Data Observability Tools market versus Datadog’s leadership position in 2022. Gartner’s next magic quadrant study is expected to be released in the next 2-3 months, and another report may highlight changes in the market’s appeal for Datadog’s peer tools and products.

4 Key Factors to look for in Datadog’s Q1 FY24 earnings report

I wanted to emphasize a few things that I think are important to look for in Datadog’s earnings report next week:

-

As I mentioned earlier, I will be looking for further commentary from management on progress made on their Land and Expand strategy and expanding product adoption trends. In addition, management’s outlook about general IT spending in the DevOps space, in addition to changes to the vendor consolidation trends that had benefited them last year, will be crucial factors to look for. Key question from the insight here is: Can Datadog continue to consolidate market share due to its tailwinds?

-

AIOps tailwinds: The recent earnings reports by Microsoft and Google showed that cloud spending is still strong. Microsoft’s Azure reported 31% growth in the past quarter, stronger than the ~28% that was widely expected, while Google’s GCP grew 28%. Both Microsoft and Google are cloud partners for Datadog’s data observability and application performance monitoring tools, specifically for AIOps. Any growth seen from Datadog’s AIOps solutions will also be important.

-

Q1 Consensus Estimates: Per SA, markets are looking for Datadog to report EPS of ~$0.34, representing y/y growth of ~22.9% on revenue of $591.7 million. Both of these expectations are at the higher end of Datadog’s own guidance range of 33–35 cents of EPS on $587–$591 million of revenue, suggesting optimism. Personally, I expect this to be achieved; however, the key will be in the guidance that management sets for the next quarter.

-

Q2 and Full Year Guidance: For Q2, markets expect guidance of ~$0.34 in terms of earnings per share on revenue of $619.9 million. At the same time, consensus estimates for full-year EPS are ~$1.49 on full year revenue of $2.59 billion. Any updates in any of these guidance ranges for Q2 and/or for the year will impact Datadog.

Takeaway

My long-term thesis for Datadog still holds that the company’s growth will remain strong due to significant tailwinds seen in its end-user DevOps market. As cloud spend increases and enterprise clients widen their adoption and need for data observability tools, Datadog remains a beneficiary of these trends, along with the vendor consolidation tailwind it gained from last year.

However, the expectations are high as it heads into Q2, leading me to maintain my Hold rating on Datadog.